Https Www Mycreditcard Mobi Esecurity Login Loginsubmit Action

3D Secure One-Fourth dimension Countersign (OTP)

Enjoy online shopping with 3D Secure One Fourth dimension Password service from VISA & MasterCard which will protect your credit/ Debit card online transaction . 3D Secure Erstwhile Countersign volition send special password to your mobile telephone number which already registered in Bank system every time you lot do online shopping on a merchant with 3D Secure facility, therefore it volition minimize your credit/ Debit card being misused.

If your Standard Chartered credit card has been registered and have 3D Secure Password before, that password is not valid anymore since Dec 9th 2016, every online transaction on 3D Secure merchant, you will become Onetime Password (i fourth dimension use password) in the form of text message (SMS) to your mobile phone number which has been registered in the Bank, which you must fill in the 3D Secure page that provided by the merchant itself.

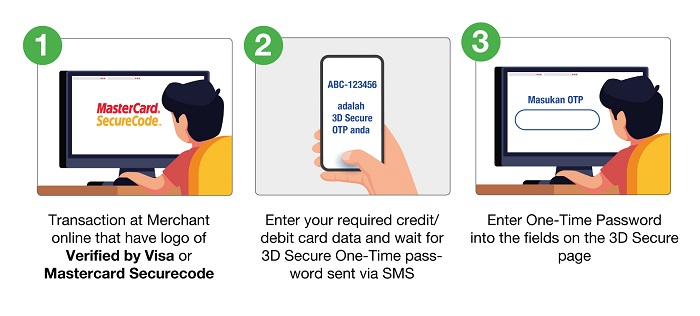

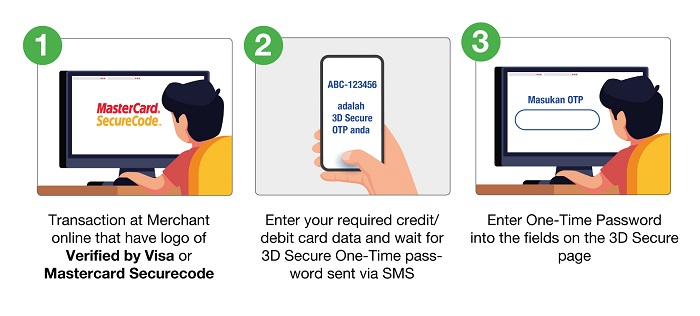

Step to Online Transaction with 3D Secure OTP

The steps in more detail:

Stride ane:

Sign in to a merchant online that accepts Visa or MasterCard for 3D Secure service. It displays logo Verified by Visa or MasterCard SecureCode on the related merchant online page.

Step ii:

Make the transaction as you need up to the checkout process, and blazon your credit carte/ Debet card details as required. Further confirm if the data are right and to continue.

Stride 3 - Only for a transaction using a credit card

Go to the 3D Secure page.

For Credit card, for Primary Card Holder, click "Jalankan". For Supplementary Card Holder, enter the name on the credit bill of fare and click "Jalankan"

Footstep 4:

The 3D Secure page will enquire you to enter your Quondam Password (OTP) into the box provided. Enter the Former Countersign digits as yous accept received via SMS to your mobile phone number that registered in the Standard Chartered system, and and so click 'Enter OTP'.

Note:

- For a Supplementary Credit Card Holder, SMS of your OTP will be sent to your mobile phone number as soon as it is already registered in the Standard Chartered organization. Otherwise, SMS of your OTP will be sent to the Chief Card Holder.

- If you lot have not received the SMS of your OTP, you may request for a echo sending of your OTP past clicking 'resend OTP'

- You will accept 3 chances to enter your OTP or make resending request. If this is non successful, the transaction will be cancelled and you will return to the merchant online folio.

- In order to use 3D Secure OTP, please brand sure that the mobile phone number y'all are using is already registered in the Standard Chartered system.

Step 5:

When you lot have successfully entered your OTP, you will become back to the online merchant page with confirmation that the transaction is succeeded.

Note:

For Debit cardholder, after the transaction is successful, your account will be automatically debited with transaction amount. We suggest y'all to check your account residue afterwards successful transaction.

- What is One-Time Countersign (OTP)?

-

OTP is a security feature service for online transaction. When you lot are transacting online where the merchant site requires yous to own OTP, it will be sent to your mobile phone via SMS. Yous must and then enter the OTP to complete the transaction. This service applies only to credit/Debit card holders whose mobile phone numbers are registered in the Standard Chartered system.

- What are the benefits of OTP?

-

OTP provides more security equally it requires yous to become through an authentication process when you are making an online transaction using Standard Chartered Visa and MasterCard credit carte in a merchant online that has a logo Verified past Visa or MasterCard SecureCode.

- Do I need to register my Standard Chartered credit carte to enable me to enjoy this service?

-

Registration for OTP is not required Yet, this service applies merely to Credit/ Debit card holders whose mobile phone numbers are already registered in the Standard Chartered organization.

- Is OTP required for all transactions in merchants online?

-

No, simply online merchant who participated and have the logo Verified by Visa or MasterCard SecureCode that require you to enter the OTP to consummate the transactions.

- How tin can I know if I need an OTP to complete my online transaction?

-

Check for a logo Verified by Visa or MasterCard SecureCode at the participating online merchant.

- Will I be able to enjoy these benefits when transacting online at the merchants that are non connected to this service?

-

Unfortunately no, but this service is already available in many online merchant.

- Can OTP be sent to all mobile phone numbers?

-

OTP tin exist sent to both local and international phone numbers already registered in the Standard Chartered system.

- If I do non have a mobile telephone number that is registered in the Standard Chartered organization, can I still make transactions online?

-

No, you lot will non exist able to do transactions online at the merchants that take a sign Verified past Visa or MasterCard SecureCode. If you desire to update your data in the Standard Chartered organization, please contact Standard Chartered Contact Centre at 021-57999988.

- How do I update the data of my mobile phone number?

-

Y'all may contact Standard Chartered Contact Center at 021-57999988.

- For credit card, can my supplementary card holder enjoy this service equally well?

-

If an online transaction is made by a supplementary card holder whereby only the mobile phone number of the Primary card holder is registered, the OTP volition be sent to the mobile telephone of the Master card holder. As the Primary carte holder, you volition receive an SMS OTP that informs yous that the OTP request has been made by your supplementary card holder. If the supplementary card holder owns a mobile phone number that is already registered in the Standard Chartered system, he/she and then will receive SMS OTP directly on his/her mobile telephone number.

- What should I do if I accept not received the OTP?

-

OTP is valid only for Standard Chartered credit card holders with mobile phone number registered in the Standard Chartered system. If you practise not receive SMS of OTP within 30 seconds after you lot have entered the web folio that requires yous to enter the OTP, you can click "Resend OTP" to request the resending of the OTP. Yous can also contact Standard Chartered Contact Centre at 021 57999988 to ensure that your mobile information are current and accurate.

- What will happen if I take wrongly entered OTP for several times?

-

Yous may brand three attempts to enter your OTP. However, if y'all notwithstanding enter the wrong OTP after the third attempt, yous will exist returned to the merchant's online transaction page to make a repeat transaction.

- How long volition OTP be valid? What should I practice if I fail to enter my OTP until information technology expires?

-

Your OTP is valid only for 8 minutes. If after eight minutes you still take not entered it, you lot may so click the "Resend OTP" to ask for the resending of the OTP.

- Can I receive the OTP when I am overseas?

-

Yes, we volition send the OTP to your mobile phone number already registered in the Standard Chartered system. When yous are overseas and using an overseas mobile service provider, please brand sure your mobile phone is able to receive international SMS which also means your mobile phone can receive the OTP.

- Terms and Conditions of the Ane-Fourth dimension Password for online transactions using your credit/Debit bill of fare

-

Your utilize of the One-Time Countersign (OTP) service provided by Standard Chartered Bank Indonesia (the "Bank") is subject field to the post-obit terms and atmospheric condition.

Please read these Terms and Weather condition carefully and brand sure you accept fully understood before using this service. By using this service after you have read these Terms and Conditions shall mean that you have accepted such Terms and Weather condition.

The Terms and Conditions constitute an integral office of the General Terms and Weather condition of the Credit Card and/or the Account.

- When making an online transaction that requires OTP, the OTP will exist sent to your mobile phone number already registered in the banking company organization via SMS. You must then enter your OTP to complete your transaction on the folio of your device'southward screen when transacting online. Registration for OTP service is non required. If you are not able to enter the OTP, or authentication via this service fails, the merchant online will reject your card for this transaction. Yous hold that we are not responsible for the rejection by such merchant to accept your card payments on the basis of this

- By using this OTP service:

- Yous agree to provide your data required for the transaction authority procedure in the utilize of this OTP service;

- Yous authorize the Banking concern to request from a tertiary party equally specified by the Banking concern, including the client credit bureau and other customer reporting agencies concerning your financial continuing and your credit card that will be used for this service.

- You agree to keep the confidentiality of your menu number and other verifications or personal information that you have entered into this service (Information Security). If you lot allow someone else use your Data Security or you tell your Data Security to others, you will be responsible for all claims, losses and other consequences arising from and relating to all transactions that accept taken place using this service, and all activities that have occurred past using you Information Security.

- The OTP service tin exist used just for transactions at the merchants online that have 3D Secure facilities:

- Verified by Visa or Mastercard SecureCode. You fully understand that by using this OTP service, it will not, in any way, mean that the Banking concern recommends certain merchants, whether these merchants require the apply of OTP or not. For example, the Banking company does non verify the merchant identities or the quality of appurtenances and services they provide.

- As long as permissible by the applicable laws:

- You agree that the Bank is not liable for losses arising from your failure to comply with these Terms and Weather.

- In accordance with the nature of these services, the Bank shall not exist liable for any loss or impairment to your data, software, calculator, telecommunication or device resulting from its utilize. Nor the Banking concern is responsible for, and shall non be responsible for, any damage to, or viruses that may infect your computer or other devices for your admission, to utilise or download for this service (including, without limitation to the website).

- The Depository financial institution is non responsible for any loss or damage arising from this service unless the loss or impairment is directly and caused past the Bank's negligence or fault.

Https Www Mycreditcard Mobi Esecurity Login Loginsubmit Action

Source: https://www.sc.com/id/en/ways-to-bank/3dsecure

Posted by: mcneeslabsed.blogspot.com

Comments

Post a Comment